-

About

-

Academics

- Physician Assistant

- Special Master’s (MBS)

-

Admissions & Financial Aid

- Tuition & Fees

-

Student Life

-

Research

- Research Labs & Centers

-

Local & Global Engagement

- Global Health Program

Financial Literacy

Tufts University believes very strongly in educating its students about a wide variety of financial topics. Informed students will make good choices about their futures, and will be better able to cope with the complex issues that face them upon graduation and beyond. The Office of Financial Aid is a resource for questions about general loan repayment, consolidation, Public Service Loan Forgiveness, and Income Based Repayment plans.

Our Planning for $uccess Financial Literacy Program aims to provide students with a broad financial literacy education that dives deeper than the typical debt management and loan repayment strategies. We wish for you to be financially savvy in a variety of topics—credit, budgeting, identity theft prevention, and buying a home, just to name a few—and assist you in this endeavor by offering sessions from third-party experts in these fields and delivering you quality financial tips and information.

-

The Planning for $uccess Financial Literacy Program aims to provide Tufts School of Medicine students with a broad financial literacy education that dives deeper than just the typical debt management and loan repayment strategies. We wish for you to be financially savvy in a variety of topics—credit, budgeting, identity theft prevention, and buying a home, just to name a few—and assist you in this endeavor by offering sessions from third-party experts in these fields and delivering you quality financial tips and information.

Fall 2019 Planning for $uccess newsletter

A sample of our sessions:

Affording a Career in Primary Care - Topics covered include Income Based Repayment (IBR), Public Service Loan Forgiveness (PSLF), Primary Care Loans (PCL), and the National Health Service Corps (NHSC) Loan Repayment Program. While financials should never determine your specialty, we realize it may have an impact and hope to break the myth that you cannot afford to practice in Primary Care. While we cannot cover every possible scenario in this presentation, we want to provide you with a high-level overview to further enhance your knowledge and get you thinking about the options available. This presentation is intended to begin the communication process with the Office of Financial Aid on this topic so you can make quality financial decisions pertaining to your future.

Mortgages for Physicians – This session is designed for medical students just prior to graduation. Presenters include both a principal financial planner and president of a mortgage company to discuss topics that include but are not limited to: the importance of saving for retirement, purchasing malpractice and disability insurance, maintaining good credit, paying debt versus savings, and implementing a strategic financial plan, the importance of paying debt versus saving, how to implement a strategic financial plan, purchasing a home versus renting, basic information on securing a mortgage, and detailed information and nuances one should consider and expect when purchasing a home while in residency.

Intro to Financial Planning - Planning for $uccess aims for our students to be financially savvy both now and in the future. Topics of discussion include saving for retirement, malpractice insurance, maintaining good credit, the importance of paying debt versus saving money, and implementing a strategic financial plan. More information to come!

-

Building credit and maintaining financial health will positively affect many aspects of your future, and mistakes you make now may hinder your ability to reach many of the goals you have, such as buying a house or even renting an apartment. Credit is one's ability to obtain goods or services before actually paying for them. Having "credit" is based on the trust that someone will make payment in the future. Someone who has honored their financial commitments in the past will have good credit– or in other words – they will be deemed creditworthy.

Sources: AAMC & MyFico.com

Someone's creditworthiness is easily revealed in their credit score, a 3-digit score assigned to the individual based on their past behavior with money.

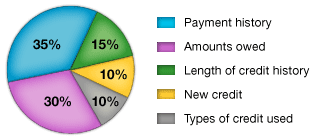

This score is calculated using several factors:

Your credit score is a snapshot of your financial health and history, but your credit report provides a complete view of your financial responsibilities. Your credit report includes your:

- Name and aliases

- Employer

- Contact information

- Addresses (current and previous)

- Credit inquires

- Detailed information on loan payments, including amounts borrowed and payment histories

- Public records

We recommend that students review their credit reports on annualcreditreport.com, where you are provided with one free credit report from each of the credit reporting agencies (TransUnion, Equifax, and Experian). To best keep tabs on your credit, check one report at a time, so that you can space your free reports out throughout the year.

To build good credit, you must establish the following habits:

- Pay bills on time

- Pay before the due date, preferably with automatic withdrawals

- Pay down outstanding balances

- Check your credit report periodically

- Protect your identity

Disputing Errors and Avoiding Identity Theft

It is important to review your credit report so that you can be cognizant of errors and can dispute them in a timely manner. Typical errors found on credit reports include duplicate accounts, inaccurate payment history, and negative information that should have "aged off." You can dispute the errors with the credit agency who issued the report.

- TransUnion: 800-888-4213 (general) or 800-680-7289 (fraud); P.O. Box 2000, Chester, PA 19022

- Equifax: 800-685-1111 (general) or 800-525-6285 (fraud); P.O. Box 740241, Atlanta, GA 30374

- Experian: 888-397-3742 (general and fraud); PO Box 2002, Allen, TX 75013

Identity theft is a serious matter that occurs when someone steals your personal information to use for themselves, usually to obtain lines of credit in your name. It is a crime that can take years to resolve and can severely damage your finances. Consumer information regarding identity theft can be found on the Federal Trade Commission's website.

A good educational resource on credit & other personal finances is Credit Card Insider.

-

A student's approach to debt management is often very individualized, and no one solution will fit everyone. The Office of Financial aid recommends that students with detailed questions set up an appointment to meet with a counselor in person. Such sessions will typically last around an hour, and you should bring documentation of your loan history from the National Student Loan Data System and a list of your questions. Students are often most concerned with how the different options available for paying back federal loans.

Saving Money Over the Long Run = Higher Payments Now

The repayment plan that will cost you the least amount over time is the Standard 120 Payment Plan. Making extra payments towards your loans will lower your balance faster, and allow you to complete repayment in less time, thereby accruing less interest.

Lower Payment Now = Paying More Over the Life of the Loan

Students who are not earning much income are eligible to apply for a forbearance from their lender. This is the equivalent of claiming an income-hardship, and not being able to pay. This will result in the lowest monthly payment, but interest still accrues even though payments are not required. This will only increase the amount you pay over the long run.

Finding a Happy Medium

There are other repayment plans available like Income Based Repayment, Extended Repayment, and Graduated Repayment plans. These plans typically fall somewhere between the Standard Repayment and Forbearance options. The longer it takes you to repay a loan, the more interest you will accrue, and the more you will pay in the long run. You must reconcile this fact with your own ability to pay. Students must be aware of their expected financial lifestyle and their future goals. Paying loans off quickly is an advantage, but financial counselors will often recommend maintaining at least a small savings account for emergencies. In the end, the student must prioritize their financial goals, and pick a repayment option that fits all their needs.

-

Many students at Tufts School of Medicine will use loans to pay for a portion of their tuition or living expenses. When borrowing for these costs, it is important to carefully consider your options, and evaluate all relevant factors. There are two main types of students loans, those offered by the federal government, and those offered by private lending institutions. The following discussion attempts to highlight some differences between the two.

Federal Loans

Unsubsidized Loan Graduate PLUS Loan Interest Rate 5.28% 6.28% Origination Fees (updated 10/01/20) 1.057% 4.228% Default Repayment 10 years 10 years Potentially IBR Eligible? yes yes Potentially PSLF Eligible? yes yes Pre-payment Penalty? no no Dischargable? yes, in case of death or total disability of student Private Loans

Interest Rate usually variable, depends on borrower's credit, potentially un-capped Origination Fees varies by lender Default Repayment 10 years, can vary by lender Potentially IBR Eligible? no Potentially PSLF Eligible? no Pre-payment Penalty? varies by lender Dischargable? varies by lender In general, Private Loan terms vary quite a bit since lenders are allowed to set their own terms. Private Loans may have lower interest rates in the short term, but there is no guarantee that they won't rise in the future. Students borrowing lower amounts, or receiving help with repayment may be able to pay their loans off completely before interest rates rise. Students borrowing higher amounts should be conscious of what their repayment schedule will look like, and what amount might be due every month. Federal loans are typically eligible for Income-Based Repayment which bases your repayment amount on your annual salary, ensuring an affordable payment. Private loans offer no such protection and monthly payments are not generally capped. If you are opting for a private loan instead of the federal programs, please be sure that you have researched and understand their loan terms.

-

Every semester students are issued refunds for their estimated living expenses for that term. Many students will accept the full amount of their aid (oftentimes loans) because they aren't sure what their budget will look like a month or two down the road. It can be difficult to calculate a reliable budget, especially if students are not from the Boston area. Students usually go about this challenge in one of two ways:

Solution 1

Many students accept the full amount of their aid because they know that they can return any federal loan funds up to 120 days after they disburse. This gives them approximately 4 months to work out a viable spending plan, and get on track with their expenses. If they have more than what they need for the remainder of the semester, they simply drop by the Office of Financial Aid to fill out a reduction memo, and make a payment to the Bursar for the return amount. Students do not accrue any interest, nor do they incur any processing fees on the amounts that they return.

Solution 2

Some students will request a reduction in their financial aid package before the funds disburse. This means that the initial refund amount is smaller, but they are not completely giving up their eligibility. They may come back to the Office of Financial Aid at any point throughout that semester, and request an additional disbursement up to their original eligibility.

With all of the related costs to borrowing student loans such as interest and capitalization, it is important to limit borrowing to only what is necessary. It is highly recommended that students create spending plans in order to organize their budgets for the year, which in turn aids in keeping borrowing at a minimum. There are several worksheets and websites out there to assist you in this activity. Some helpful resources include:

- Mint.com — This tool organizes and categorizes your spending for you; just link your various accounts and watch it do the work. You can set limits for yourself for various categories, i.e. coffee or groceries, and you will be sent alerts when you near your thresholds to keep your spending in check.

- AAMC Interactive Budget Worksheet — A simple way to compile your expenses and determine your borrowing needs.

-

There are a variety of repayment plans available for most federal loans, and the choice can sometimes seem overwhelming. If you don't contact your loan servicer to select a repayment plan, you will automatically be placed in Standard Repayment. Students who wish to choose a different repayment plan should contact their servicers before their grace period expires to select the plan which best suits their financial goals. In general, the faster you pay down your loans, the less you pay in the long run. The longer you take, the more interest accrues, the more expensive the loan becomes. Borrowers can pay more than is required at any point without penalty, so some students will pick a repayment plan with a low minimum payment, but send in extra money when they have it. You can browse the Department of Education's Federal Student Aid site for in-depth information.

We recommend that all medical students take advantage of their free premium access to AAMC's Medloans Organizer and Calculator (MLOC), a helpful and important resource to track and manage your student loan debt both while and after you are in school. The calculator was developed to assist medical students and residents with managing their education debt to ease the burden of keeping important loan terms and borrowed amounts organized. The MLOC provides a secure location to organize and track student loans while also displaying possible repayment plans and costs based on the borrower's specific indebtedness.

Alumni without access can utilize the tool as a guest by adding their loan history here.

All federal loan borrowers can estimate their payments and determine which repayment plan fits their needs by using the Federal Student Aid Repayment Estimator.

Here are some of the more common federal loan repayment plans:

Traditional Repayment Plans:

Income-Driven Repayment Plans:

-

It is to a student's advantage to keep expenses as low as possible. Students with high debt levels can find themselves making long-term career decisions based on the amount they have to repay instead of based on their areas of interest.

Students should consider the following tips for cutting costs:

- Clip coupons - Grocery coupons in local newspapers (especially Sunday editions) will save you a few dollars here and there.

- Skip the car - use public transportation. It is very easy to get around in Boston by foot or by public transportation. In addition, Boston is extremely expensive to store or park your car.

- Skip the land line and rely only on your mobile phone.

- Limit cable TV to what you need (no premium channels).

- Build a budget and stick to it.

- Take advantage of free entertainment - Local colleges and universities are great resources for free or inexpensive student performances, art shows, films, etc.

- Use the library for books and movies instead of buying or renting them.

- Do not "Live for Today" - things you buy today with your student loan refund will end up costing you much more when you consider the interest that may accumulate on your student loans.

- Do not use credit cards - Have one and use it only for emergencies. It may help to keep the credit card at home, tucked in a drawer somewhere.

- "Brown Bag" your lunch - Eating out is much more expensive than bringing something from home.

Borrow conservatively, and find ways to cut costs. Little savings here and there can add up to make a big difference.

Live like a student now so you can live like a doctor later!

-

In your ongoing effort to keep your costs low, take advantage of the several student discounts available to you. This is just a short list of companies which offer such discounts, but we insist that when you are purchasing something—lunch, new shoes, you name it—just ask the cashier! Not every business advertises the discounts forthright, but you don't want to miss out on saving some cash! Also, if you have a membership to AAA, there are additional businesses that may offer discounts, so we recommend you always do your research when shopping.

National businesses:

- J.Crew

- North Face

- Amazon Prime

- Fedex

- Chipotle

- Greyhound Bus

- Charlotte Russe (participating locations)

- CorePower Yoga

- Apple

- Sony

- T-Mobile

- Amtrak

Local businesses:

- If you have a Boston library card, you can find discounts to free events and discount attractions like the Aquarium, Museum of Science, Boston on Foot, ICA, Zoo New England, J.F.K. Library & more.

- AMC Loews Boston Common 19

- ZipCar—Tufts School of Medicine students join for only $15

- Several shops and services at the Prudential Center